Frequently Asked Questions

Learn more about the proposed bond, how school funding operates and the details of the proposed bond-supported projects. View the entire list of Frequently Asked Questions.

What proposal is the November 4, 2025, ballot?

Mason Public Schools is placing a zero-tax-rate increase bond proposal on the November 4 ballot. If approved, the bond would generate approximately $66 million without raising the current tax rate of 5.68 mills for Mason homeowners.

Why is Mason Public Schools proposing a bond?

As outlined in the district’s 2023-28 Strategic Plan, the district is actively continuing its commitment to modernize our current facilities and plan for future improvements. Our district has a unique opportunity to continue the improvements needed while remaining fiscally responsible to our community and not raising the current tax rate paid by homeowners.

How is it possible that this is a zero-tax-rate increase (from the existing millage rate)?

Upcoming annual bond payments associated with the November 2017 bond election are scheduled to begin declining. It is then estimated that the existing bond millage rate of 5.68 mills does not need to increase but can be extended to fund new voted bond capital improvements of approximately $66 million if the 2025 bond is approved by voters.

How and why was this plan developed?

The scope of this proposal was developed through various community engagement activities, including a community survey, a town hall session, and small-group informational discussions. The full survey results helped to determine priority projects needed in the district. More than 1,000 community members took part in a survey. Survey highlights included:

Survey Question | Community Response |

How likely would you support keeping current taxes at 5.68 mills? | Support = 65% |

Would you support improvements to the auditorium? | Yes: 74% |

What’s the best use of future bond dollars? | MMS = 6% |

Do you consider the following buildings to be excellent or good? | Elementary = 77% |

Was the 2017 bond a success? | Yes = 62% |

What are the details of the proposed bond and what buildings would be updated if the bond is approved by voters?

If approved, the bond would generate an estimated $66 million, depending on future taxable values and projects evaluated by Baker Tilly, the MPS bond financing consultant, without increasing the current tax rate paid by homeowners. The approximate bond percentage allocations and projects presented by the bond steering committee include:

- Extensive Middle School Renovations- make major renovations to student spaces, upgrade HVAC and plumbing needs, and improve public access and traffic flow

- 51% of the bond*

- High School Renovations- overhaul of existing auditorium, update HVAC system and update student spaces

- 33% of the bond*

- New Transportation Facility- increase safety and security, expand capacity, and enhance efficiency and operations

- 16% of the bond*

(* approximate bond dollar allocation per the School Bond Committee recommendations to the Board of Education.)

The new transportation facility is a unique need for our district. As a district that relies heavily on busing, we struggle to provide adequate space for our transportation and maintenance staff, as well as for our vehicles. If the bond passes, we would have the opportunity to provide staff with safer working environments, expand their capacity, and enhance daily operations and efficiency.

What does “Extensive Middle School Renovations” mean? How much would be renovated?

Community members can expect to see significant upgrades to Mason Middle School, similar to the improvements completed at Alaiedon, the Harvey Education Center, and North Aurelius Elementary Schools. Structurally, the building will remain unchanged. Still, major renovations to the following areas would be completed to update the spaces, provide more functional environments, and better support today’s learning. Planned projects include:

- Implementing additional safety and security measures

- Improving parking lots and traffic flow

- Replacing and renovating mechanical systems

- Updating classrooms with new furniture, technology, storage, and cabinetry

- Updating and renovating building finishes: tile and carpeting, windows, paint, etc.

- Renovating restrooms and plumbing throughout the building

- Updating the existing gym and mezzanine

- Updating the cafeteria and stage

What improvements and renovations are planned for the high school?

In addition to completing HVAC system upgrades, the bond would be used to renovate our aging auditorium and performing arts classrooms. Currently, the district faces challenges when hosting student performances, district meetings, and community events due to acoustic, technology, and seating issues. If approved, the bond would provide funding to:

- Improve auditorium acoustics for performers and audience members

- Replace aging lighting with energy-efficient, adaptable systems

- Update our stage, including new stage flooring, new stage curtains, and rigging system improvements

- Replace existing theater seating

- Improve storage and backstage areas to better support students and staff

- Improve band, choir, and drama classrooms to enhance student learning opportunities

What is the anticipated timing for projects in this proposed bond program?

If the bond passes, projects would take place from 2026 to 2033. Construction phases and information would be provided on the district website in future communications.

How would the bond proposal impact students and the community?

The district's goal is to continue providing students, teachers, and staff with modern, safe and secure learning environments. As outlined in the 2023–2028 strategic plan, the district identified four focus areas: 1. Instructional improvement and innovation 2. Student supports 3. Staff recruitment, retention, and development 4. Facilities and infrastructure To achieve our vision and mission, we must continue to uphold high building standards, ensuring that our schools and community remain safe and our students are learning in an environment that prepares them for their future.

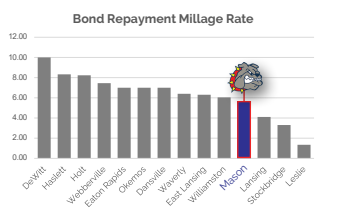

How does our community's millage rate compare to that of other school districts?

If passed, Mason Public Schools would continue to be one of the lowest millage rates in the area. Please refer to the chart below:

How can bond proceeds be used?

Bond proceeds can be used for the following items:

- Construction and remodeling of facilities

- Purchase of instructional technology equipment

- Equipment and furniture

- Site improvements

- Bus purchases

Bond proceeds cannot be used for the following items:

- Salaries and wages

- General operating expenses and maintenance

- Classroom supplies and textbooks

How is this bond different from the 2017 bond?

The 2017 School Improvement Bond provided significant improvements to all MPS elementary schools, as well as limited improvements to Mason Middle School and Mason High School. This next phase would shift the focus to the priority needs of those two buildings, as well as our transportation facility.

What is the difference between a bond and a sinking fund?

A bond is a form of borrowing, which means taxpayers must pay back the borrowed funds over a period of years with interest. A sinking fund millage is levied, not borrowed, which means the revenues are generated from taxes and do not include the district taking on additional debt or interest expenses. A sinking fund is used on a “pay as you go” basis, and all monies collected are utilized directly to benefit the district annually.

How much does the sinking fund bring in, and what is it used for?

Mason Public Schools currently has a sinking fund that was established in 2006 and is set to expire in 2026. This fund generates approximately $850,000 annually. It operates as a "pay as you go" system, allowing the district to make cash purchases for repairs and improvements as needed without incurring debt. The sinking fund is used for various purposes, including repairs to parking lots, roofs, buildings, and athletic facilities.

How does the lottery/marijuana tax/etc. generate funds for schools? Do local districts see those dollars directly?

Lottery and marijuana taxes do provide some funding for education, and these revenues are helpful. However, these revenues can’t possibly cover what schools need. Take the lottery: In many states, it was introduced with promises of boosting school budgets, but often, it ends up replacing existing funds rather than adding to them. In Michigan, the funds get placed into the school aid fund, which provides local school districts with annual funding per student (also known as per pupil funding). It also provides funding to colleges and universities, which has increased significantly over the last 10 years. The revenue from both lottery and marijuana sales are helpful, but they are a small percentage of the overall school aid fund. In addition, the school aid fund is used for more than supporting K-12 schools in traditional ways, and it’s rare for a local district to receive a state allocation for facility needs.

Where do I register to vote?

To vote in the November 4, 2025, election, you must be a U.S. citizen, at least 18 years of age by Election Day, a resident of Michigan, and a resident of the Mason Public School District. Please visit your local township or city clerk to register to vote or visit any Secretary of State office.

If I am unable to make it to the polls on November 4, what are my options for absentee voting?

All eligible and registered voters in Michigan may now request an absentee ballot. Absentee voter applications are available beginning 40 days before every election, or Thursday, September 25, 2025.

To become an absentee voter, visit:

- www.michigan.gov/vote

- Your township or city clerk’s office

Note: Once election ballots are available in the clerk’s office, you can walk into your clerk’s office, receive an absentee application, fill it out, and immediately be given your ballot to cast your vote.

Who can I contact if I have additional questions?

Please contact Dr. Gary Kinzer by email at kinzerg@masonk12.net or by phone at 517.676.6489 if you have any additional questions regarding the bond proposal.